Table of Contents

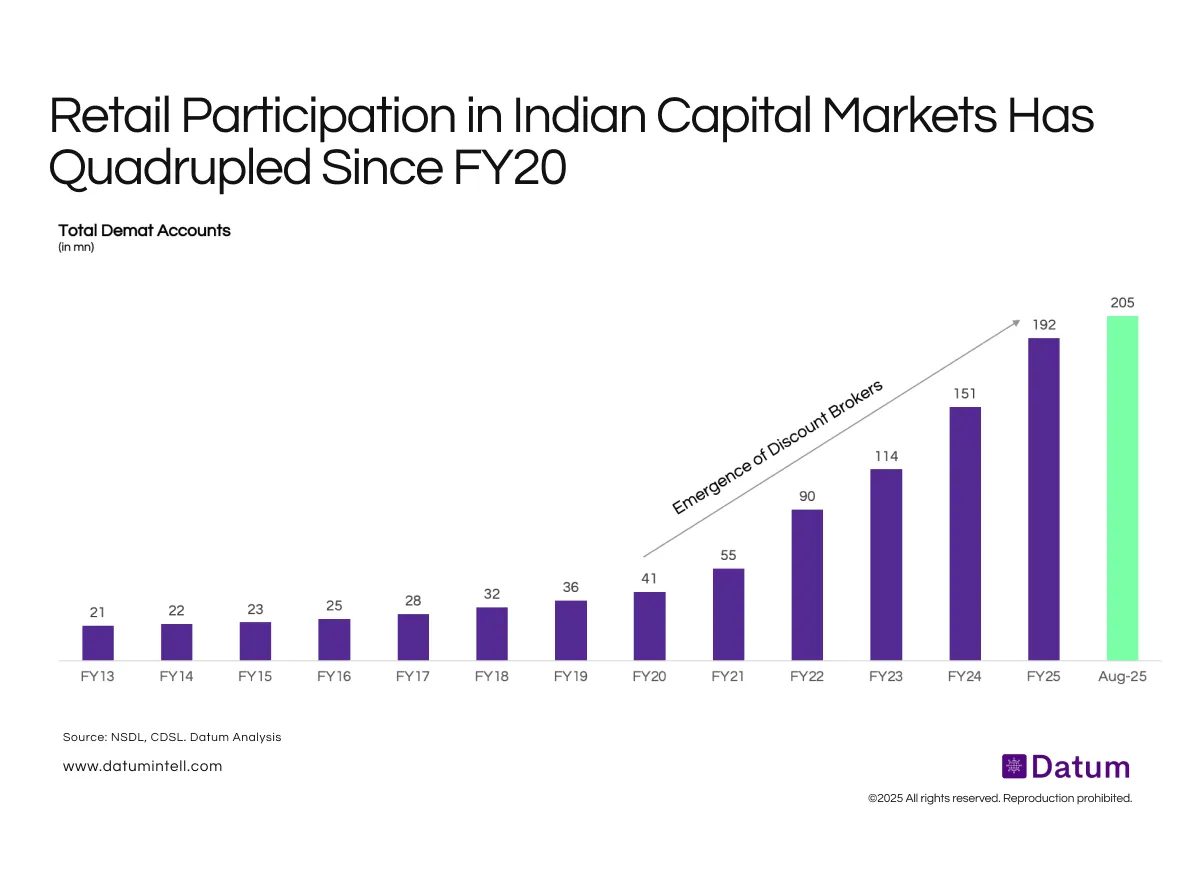

India’s total Demat accounts have surged from 41 million in FY20 to 205 million by August 2025, reflecting the massive expansion in retail investor participation. The turning point came post-FY20 with the rise of digital discount brokerssuch as Zerodha, Groww, and Upstox, which simplified account opening and reduced trading costs.

This democratization was further driven by increased financial literacy, smartphone penetration, and post-pandemic digital adoption.

What It Means

- The retail investor base in India has grown 5x in just five years, making India one of the world’s fastest-expanding capital markets.

- Discount brokerage models have permanently reshaped access to equity markets, attracting first-time investors from Tier 2 and 3 cities.

- The ongoing transition suggests that domestic retail flows will remain a structural driver of liquidity in Indian equities, reducing dependence on foreign institutional capital.