Table of Contents

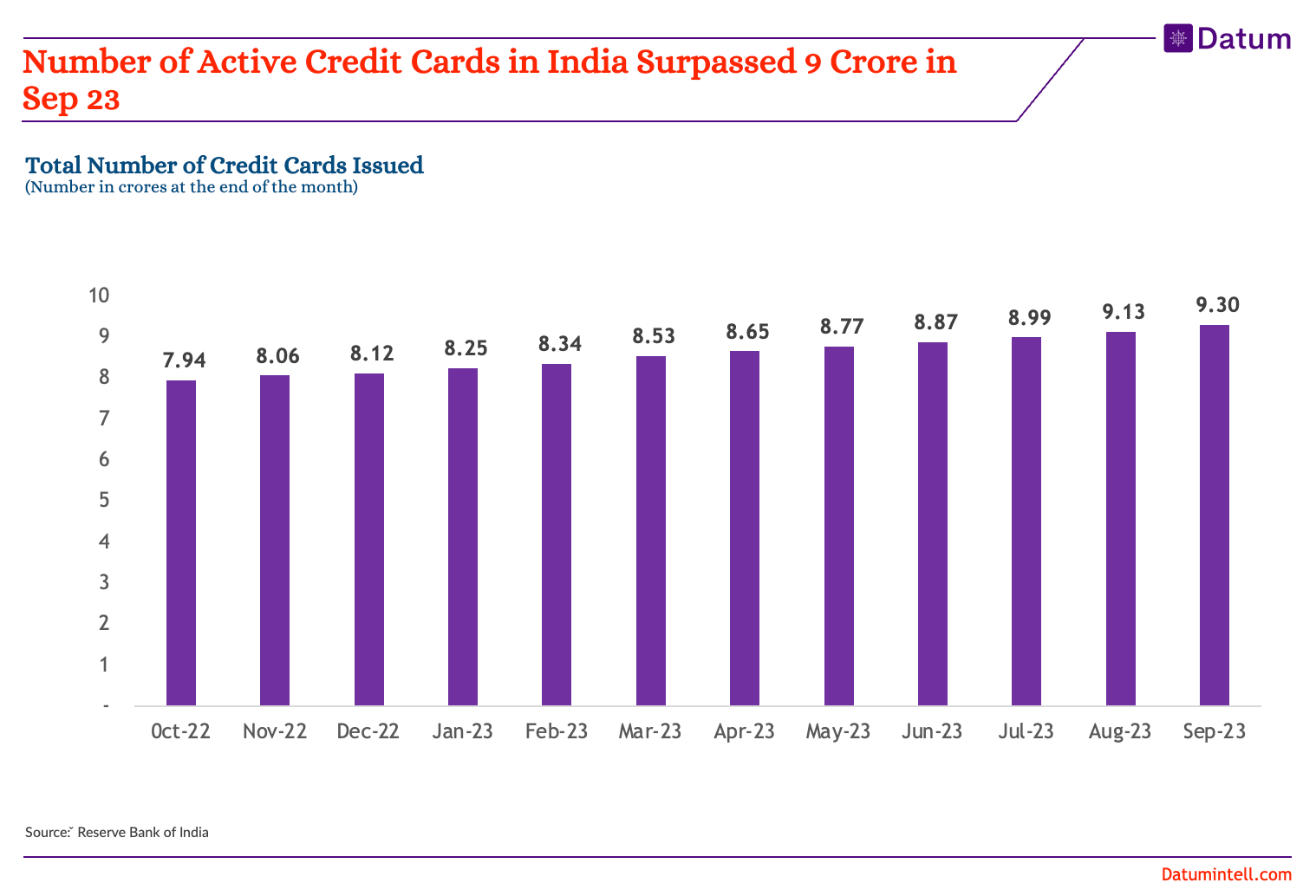

In August 2023, India marked a significant milestone by surpassing 9.1 crore issued credit cards. This noteworthy surge from 7.9 crore cards in October 2022 indicates the increasing favorability and utilisation of credit cards for transactions.

The growth trend escalated steadily, reaching 8.3 crore by February 2023 and accelerating to 8.5 crore in March, followed by 8.6 crore in April. This trajectory continued, culminating in 9.1 crore August and ultimately reaching the notable milestone of 9.3 crore in September 2023.

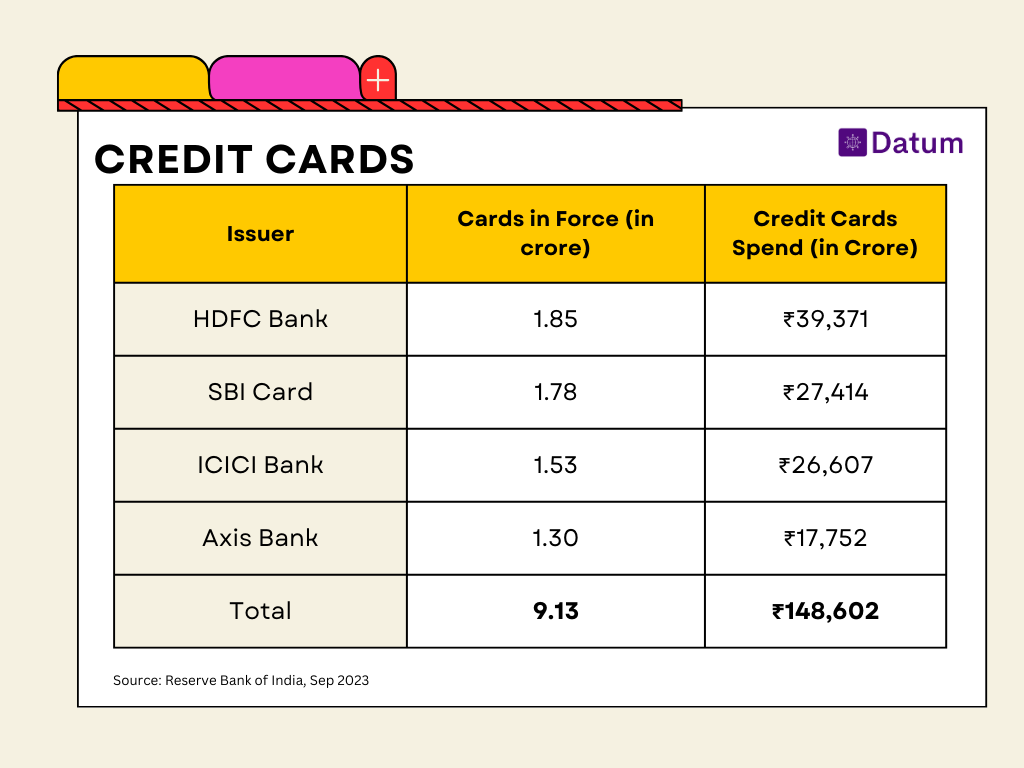

HDFC continued to maintain its position as the largest card issuer with cards-in-force at 1.85 crore followed by SBI at 1.78 crore.

Credit card spending in India hit a new high in August, reaching 148 billion rupees ($1.9 billion). This marks a 2.7% increase compared to the 145 billion rupees ($1.8 billion) spent in July. The growth in credit card transactions was seen across most major card issuers, with the exception of HDFC Bank which saw a decline. The continued increase in spending signals growing consumer confidence and comfort with credit cards in India. As more people enter the middle class and adopt digital payments, credit card usage is expected to steadily rise.

Credit card spending in October 2023 was approximately 17% higher compared to October 2022, representing an increase of 290 billion rupees ($3.6 billion). This growth was seen both for in-store purchases and e-commerce transactions.

The rising popularity of credit cards is attributed to their convenience for cashless payments and the attractive perks they offer. As awareness about credit cards expands, their adoption surges, fueling this upward trend.

This surge in credit card usage signifies broader access to financial services and a demand for safer, more convenient payment methods. The increased utilisation of credit cards is poised to bolster India's economy, fostering easier financial management for individuals across the nation.